Businesses sell their wares at the highest price that consumers will pay. At the same time, shoppers look for the lowest prices for the goods and services they want. Workers bid their services at the highest possible wages that their skills will allow, and employers strive to get the best employees for the least compensation. As much as a self-regulating market is ideal for trade, many believe that capitalism still needs some rules. Though laissez-faire advocates for allowing private entities to pursue their self-interest, it also creates room for manipulation and unhealthy competition.

Self-seeding flowers add color to an otherwise drab garden – Detroit News

Self-seeding flowers add color to an otherwise drab garden.

Posted: Tue, 08 Aug 2023 16:41:10 GMT [source]

Protectionist policies foster domestic production and help the working class, but are detrimental to the overall growth rate of the economy, as they hinder competition. The 20th-century British economist John Maynard Keynes was a prominent critic of laissez-faire economics, and he argued that the question of market solution versus government intervention needed to be decided on a case-by-case basis. Laissez-faire economics is a theory that says the government should not intervene in the economy except to protect individuals’ inalienable rights.

Notable Opinions on Laissez-Faire Economics

Private property also enables us to reflect our sense of individuality and what values are important to our family. In addition, home ownership enables us to pass down our wealth to members of our own family, who then act as custodians of that wealth. Unlike those voices on the left, conservatives take a positive view of an economic system based upon private ownership. All conservatives believe that laissez-faire capitalism is a better system than common ownership of the means of production.

- Laissez-faire (in French, “let [it/them] do”) is the belief that the government shouldn’t regulate the markets and should instead let the economy run by itself, driven by the natural forces of supply and demand.

- Theft, fraud, and monopolies prevent rational market forces from operating.

- Because this natural self-regulation is the best type of regulation, laissez-faire economists argue that there is no need for business and industrial affairs to be complicated by government intervention.

- Laissez-faire economics refers to an economic theory that has had a significant influence on the development of modern economies and on the scholarly field of economics.

She said the government should only intervene to protect individual rights. She agreed with the Founding Fathers that each person has a right to life, liberty, property, and the pursuit of happiness; they do not have an inalienable right to a job, universal health care, or equity in education. Capitalism requires a market economy to set prices and distribute goods and services.

Register to view this lesson

The function of the state was to maintain order and security and to avoid interference with the initiative of individuals in pursuit of their own desired goals. But laissez-faire advocates nonetheless argued that government had an essential role in enforcing contracts as well as ensuring civil order. Its proponents cited the assumption in classical economics of a natural economic order as support for their faith in unregulated individual activity. An economy would follow the principles of Laissez-Faire if it followed an approach where the government was not at all involved in the workings of the economy, business, or markets. Instead, the free market would regulate not only prices but also discipline producers to remain good actors. All economies, even in countries with highly Libertarian values, have some degree of government regulation and intervention.

President Hoover was unable to see out his policies as he lost reelection in 1932 to Franklin D. Roosevelt, who easily won the election because of Hoover’s association with the crisis. Although President Roosevelt departed from laissez-faire economics in many ways through the New Deal, laissez-faire ideas have never entirely been removed from economic policy in the United States. In fact, many features of the US economy are still identified with laissez-faire economics, and a more recent push toward laissez-faire ideas was seen under President Ronald Reagan. Prime Minister Margret Thatcher of the United Kingdom, a contemporary of President Reagan, also sponsored laissez-faire principles during her tenure. Russian-American writer Ayn Rand argued that pure laissez-faire capitalism has never actually existed.

Definition and Examples of Laissez-Faire Economics

It is important to note that laissez-faire economics does not mean there are no rules. As seen in the examples from the US Constitution, it is paramount in laissez-faire systems to ensure the right to private property and to ensure copyright protections. Therefore, laissez-faire economics should not be thought of as a free-for-all in which anyone can behave however they desire. There are a number of rules that are important to the functioning of the system, yet the main idea is that government intervenes as little as possible and only ensures that the system works as it should.

The government shouldn’t regulate this productive chaos –- The market should instead be allowed to regulate itself through the ‘invisible hand’ of supply and demand. Under this theory, producers will supply enough products to match the consumers’ needs the consumers will then buy them voluntarily. Any intervention by the government or any other authority becomes an obstacle to economic growth and development. The only role the government should play in such an economy would be to protect the individual’s rights. It is questionable whether any economy at any time has fully embodied the principles of laissez-faire economics; however, many laissez-faire principles have been incorporated into the policies of capitalist economies such as the United States. The United States historically emerged as a center of innovation during the 20th century, in large part because of the lack of government interference in the economy, a key laissez-faire principle.

In contrast, laissez-faire approaches reject mercantilism as well as the idea of a command economy, such as those seen in many communist countries in the 20th century. Although laissez-faire principles saw a resurgence during the times of President Reagan and Prime Minister Thatcher, these principles tend to be avoided during times of economic hardship. Popularized in the mid-1700s, the doctrine of laissez-faire is one of the first articulated economic theories. It originated with a group known as the Physiocrats, who flourished in France from about 1756 to 1778. These thinkers tried to apply scientific principles and methodology to the study of wealth and economic production. These “économistes” (as they dubbed themselves) argued that a free market and free economic competition were extremely important to the health of a free society.

Where did the term laissez-faire come from?

In modern economics laissez-faire typically has a bad connotation, which hints towards a perceived need for restraint due to social needs and securities that can not be adequately responded to by companies with just a motive for making profit. A closely related name for laissez-faire capitalism is that of raw, pure, or unrestrained capitalism, which refers to capitalism free of any regulations,[64] with low or minimal[65] government and operating almost entirely on the profit motive. Despite this inauspicious start, laissez-faire practices, developed further by such British economists as Smith and David Ricardo, ruled during the Industrial Revolution of the late 18th and early 19th century. And, as its detractors noted, it did result in unsafe working conditions and large wealth gaps.

- In the late 19th century the acute changes caused by industrial growth and the adoption of mass production techniques proved the laissez-faire doctrine insufficient as a guiding philosophy.

- One of the main criticisms of laissez-faire economics is that it promotes inequality and monopolization as a few people and companies tend to secure wealth and the means of production without government intervention.

- New customers need to sign up, get approved, and link their bank account.

- And, as its detractors noted, it did result in unsafe working conditions and large wealth gaps.

- While such laws seem to add to the concept of laissez-faire, they go against the Darwinist idea of survival of the fittest that laissez-faire prescribes.

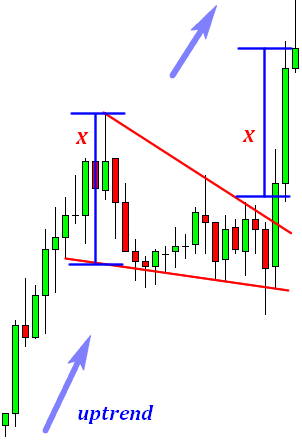

Put simply, the law of supply asserts that, as a price for a product rises, more people are willing to supply or produce that product. On the other hand, the law of demand argues that, as a price for a product rises, fewer people are willing to demand or buy that product. The interaction of these two principles results in how prices for items are set, as well as what quantity of a given item will be produced. Laissez-faire economics believes that this natural interaction of supply and demand should mostly be left alone by governments, which should refrain from intervening in the economy because doing so would interrupt the natural market equilibrium. Laissez-faire is the belief that the government shouldn’t interfere in the market. People make choices depending on their tastes, needs, and rational self-interest.

Benefits of Laissez-Faire Economics

Lastly, the absence of taxes leaves companies and employees alike with greater spending power. It also discourages corruption that can arise as a result of bureaucrats with limited knowledge but immense regulatory power. Rational market theory ignores human reliance on emotion when buying even a single stock.

Another core feature of laissez-faire economics is the principle of a free market economy. Essential to a free market economy is the law of supply and demand, that prices will naturally be set by how the participants in an economy produce and consume products. Freedom is important in this system because private entities must be allowed room to operate in an economy what is the laissez faire view point without being placed under the control of a state. Private entities in a free market economy are thus free from the dictates of a government in terms of what to produce and what to consume. In contrast to a free market economy, a command economy is a system under which a government controls the production and consumption of goods as well as their prices.

Despite his desire for a balanced budget, Hoover’s laissez-faire approach to the Depression added $6 billion to the debt. Options trading entails significant risk and is not appropriate for all customers. Customers must read and understand the Characteristics and Risks of Standardized Options before engaging in any options trading strategies. Options transactions are often complex and may involve the potential of losing the entire investment in a relatively short period of time. Certain complex options strategies carry additional risk, including the potential for losses that may exceed the original investment amount. A notary is an individual recognized by a state government as someone able to act as an impartial witness in the signing of important documents.

It makes sure no one is manipulating the markets and that all have equal access to information. Commission-free trading of stocks, ETFs and options refers to $0 commissions for Robinhood Financial self-directed individual cash or margin brokerage accounts that trade U.S. listed securities and certain OTC securities electronically. Keep in mind, other fees such as trading (non-commission) fees, Gold subscription fees, wire transfer fees, and paper statement fees may apply to your brokerage account. A public company is a corporation that’s owned by external shareholders and trades company shares to members of the public on a stock exchange or securities market. A tax return is a document that most people must file annually with the government to report their income and calculate tax liability. A bank is an institution that accepts deposits, protects customers’ money, extends loans, and provides other financial services.